Reach out to us!

Start your AI journey today and let us help you understand your business better. Send us an email or book a meeting with one click!

Reach out to us!

Start your AI journey today and let us help you understand your business better. Send us an email or book a meeting with one click!

6th February 2026

Leo

Conventional wisdom says that stores are cost centres. They require staff, stock, fixtures and constant upkeep, yet a quiet revolution is taking place: physical stores are becoming media channels.

Retail media networks (RMNs) let retailers sell advertising space on their own surfaces, for instance, the websites, apps and screens that consumers interact with and capture a share of the marketing budgets that once flowed to TV and social media. The U.S. retail media market is projected to be worth about $105 billion by 2027, and profit margins for mature networks are often in the 50‑70 percent range. Seven in ten companies expect to increase their retail media budgets in 2025. In other words, stores are no longer just places to sell products; they are platforms for brands to reach customers in the moment of decision.

This article looks at how in‑store media works, why most deployments fail, and how data‑driven campaigns and smart management can turn screens from expense to earnings. It uses a diagnostic tone, is your signage an asset or a liability? and links to appropriate Merlin Cloud solutions (for example, the Kiosk Zone or Campaigns pages for digital signage, Product Zones for merchandising compliance, and Retail Analytics for ROI measurement).

Retail media networks emerged in digital commerce, but the trend is shifting into physical space. Analysts note that retail media sits “closer to the basket than almost any channel,” letting brands link exposure to actual sales. Every major retailer from Amazon to Kroger is building RMN businesses, chasing a share of that $105 billion opportunity.

The economics are compelling: high margins, closed‑loop measurement and access to purchase data that digital platforms lack. In the U.K., commentators like Morag Cuddeford‑Jones argue that in‑store retail media has always mattered; 77 percent of shoppers will add unplanned items to their basket when exposed to in‑store media, and 79 percent will consider a new brand.

Physical retail is not dying, it is becoming a stage for media and merchandising.

Consumer packaged‑goods (CPG) companies invest heavily in awareness campaigns but often struggle to reach customers at the moment of truth, i.e. when the shopper is physically in front of the product.

Only retailers own that final metre. Stores can provide context that online ads cannot: proximity to product, immediacy, and the credibility of a trusted retailer. Research from IPG Mediabrands and Momentum Worldwide finds that almost half of shoppers always or often notice in‑store media, and that the physical environment drives significant unplanned purchases. By building a retail media network, retailers offer brands a unique channel and generate new revenue from their footprints.

Many retailers equate installing screens with communicating value. They buy impressive displays and then play generic loops. Consultant Jordan Feil notes that a major clothing retailer spent six figures on a video wall whose content “could have been for any brand”. The mistake was designing content for the screen rather than for the shopper. Feil says that a screen must answer “what should I look at?” or “what’s the offer?” within three seconds; otherwise it becomes decoration.

Many implementations also lack a content plan; after launch the same promotions loop for months until everyone forgets the login. Without strategy and regular updates, screens fade into the background and deliver no value.

Field observations reveal three big killers of digital signage ROI:

Broken or blank screens.

Bradley Cooper from Digital Signage Today writes that he regularly encounters malfunctioning displays with blank screens or even Windows desktop backgrounds. These failures destroy trust; they remind customers of neglected technology and signal that no one is monitoring performance. The cure is proactive health monitoring and swift maintenance.

Bad attract screens.

Attract screens are meant to invite engagement, yet poorly designed visuals can repel. Cooper recounts kiosks with “soulless” virtual people staring at shoppers. Attract screens should offer a clear motivation – local artwork, a discount or a relevant message and should be tested for effectiveness.

Poor content quality and relevance.

Content that is pixelated or out‑of‑season (for example, advertising warm‑weather products on a cold day) undermines credibility. Feil notes that retailers often run out of things to say after launch. Without a content calendar and ownership, screens end up showing stale loops. Further, many companies measure screen uptime instead of business outcomes. Feil warns that focusing on technology metrics rather than sales lift means you cannot prove value.

To sell media space to brands, retailers need more than footfall counts. They must provide metrics that prove exposure and influence. Rockbot’s guide to digital signage KPIs lists six core metrics: impressions, interaction rate, conversion rate, dwell time, sales lift, and customer satisfaction.

Impressions measure how many people viewed the screen; interaction rate counts touches, QR scans or gestures.

Conversion rate ties a viewing event to a purchase, often through POS correlation or dwell‑time analysis. Sales lift compares performance of promoted products in stores with and without the campaign. Customer satisfaction can be captured via surveys or sentiment analysis.

Modern retail media networks leverage sensors and AI cameras to capture these metrics. Camera analytics or foot‑traffic counters record impressions, while dwell‑time analysis shows how long customers linger near displays.

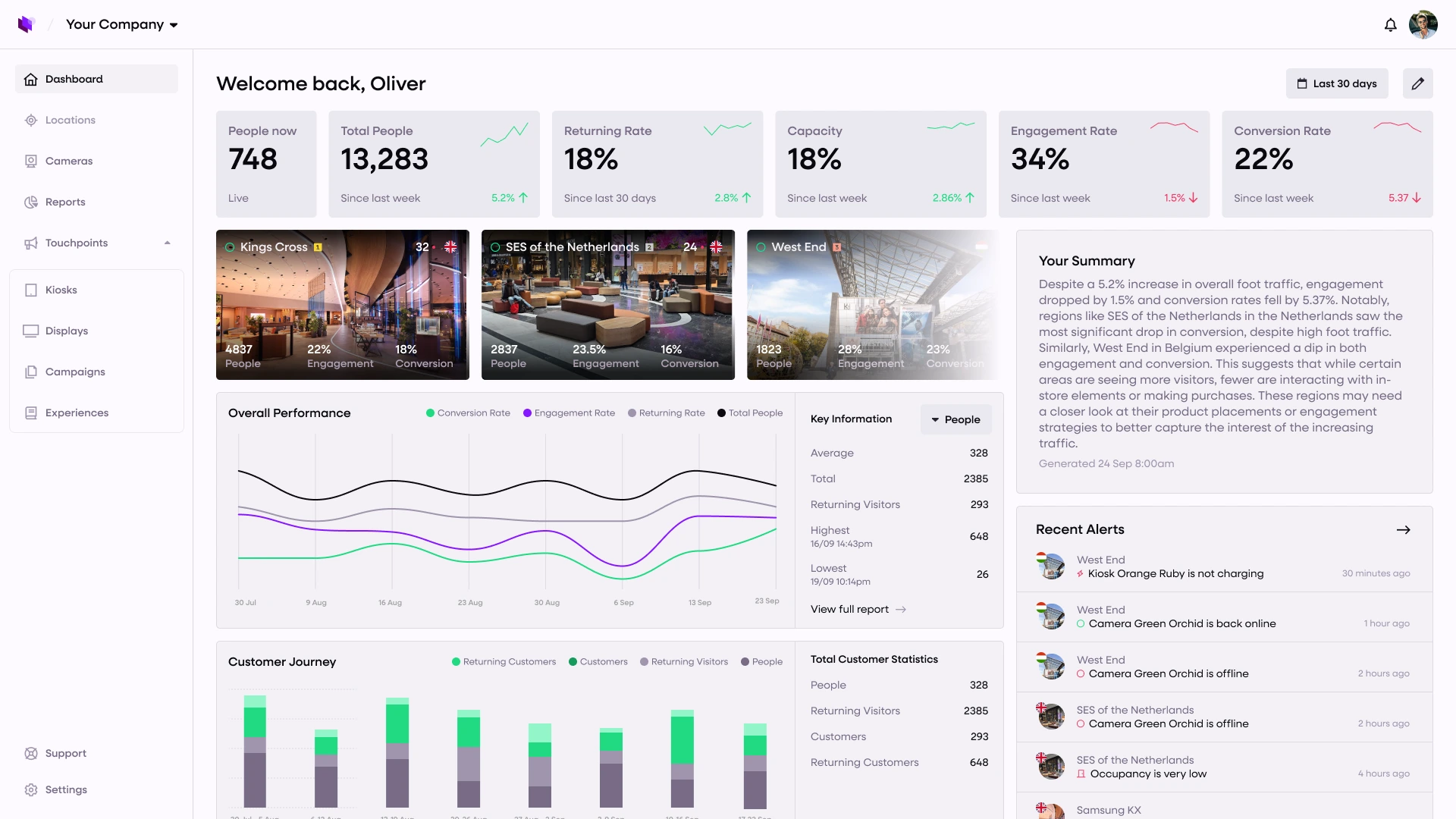

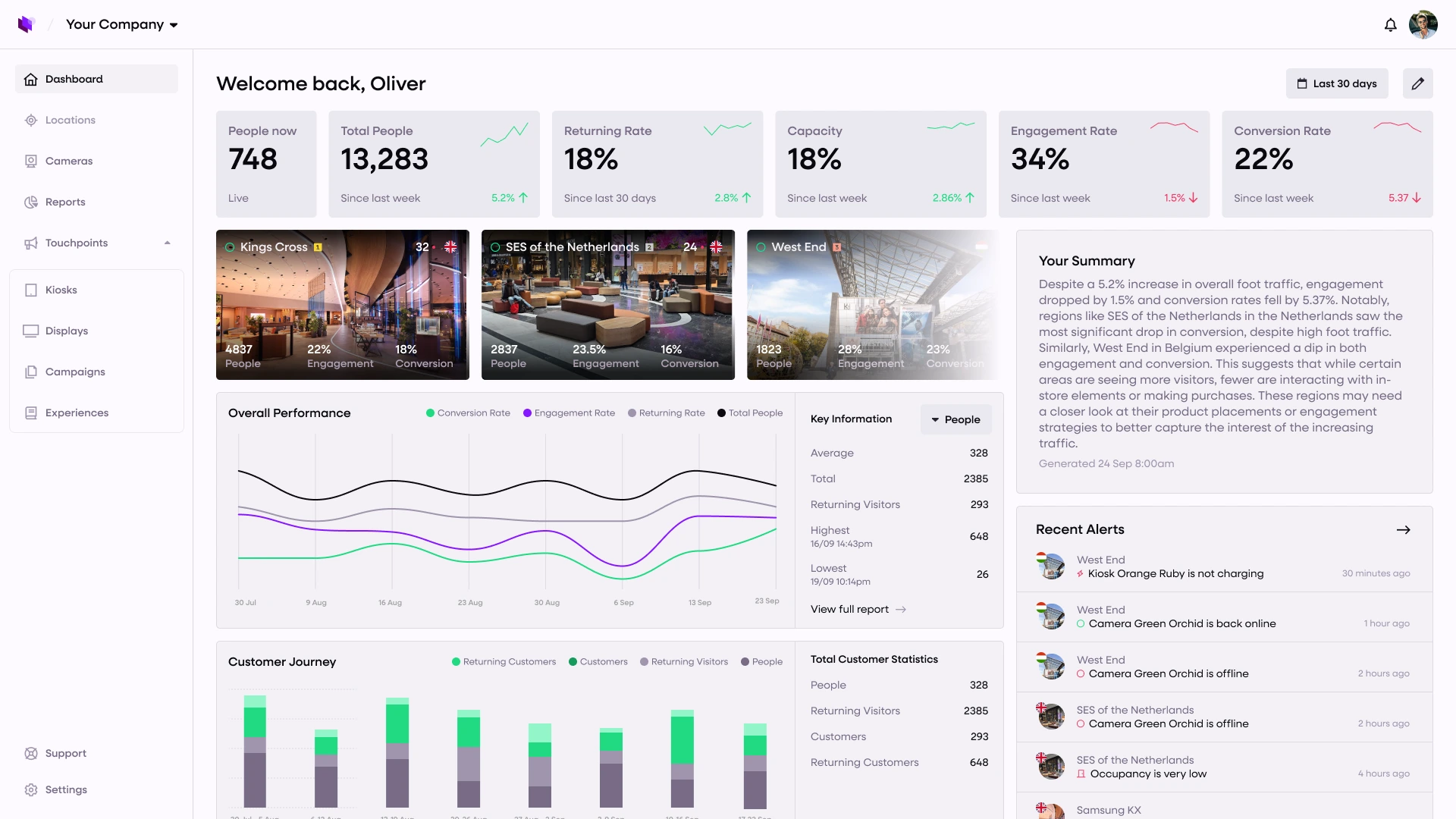

Correlating this data with point‑of‑sale systems reveals whether the advertisement influenced purchases. Platforms like Merlin Cloud integrate these insights into dashboards, letting managers see heat maps, queue lengths, and conversion lift in each Product Zone.

When a CPG brand asks for evidence, the retailer can present anonymised metrics showing how many shoppers saw the ad, how long they engaged, and how sales responded – turning screens into accountable advertising inventory.

One reason digital signage fails is the operational burden of updating content. Traditional print campaigns require weeks of planning; as a result, head office sends point‑of‑sale materials but local teams install fewer than 40 percent of them.

Digital signage solves this only if content management is centralised and easy. TechDay notes that with cloud‑based CMS systems, marketing teams can change content across thousands of stores within minutes. This “speed to screen” means a campaign can pivot in hours instead of weeks including update all screens when a product sells out, swap out irrelevant ads during a snowstorm, or end a promotion when the stock is gone.

Good scheduling keeps messages relevant. Look Digital Signage explains that modern scheduling tools allow content to play at specific times of day, on certain days of the week, or in response to external triggers such as weather or social‑media trends.

For example, a coffee shop might show breakfast offers in the morning and switch to afternoon snacks later in the day. A clothing retailer could schedule outerwear promotions during cold weather or display luxury ads when customer demographics suggest a high‑value shopper is nearby.

By connecting your Campaigns feature to data such as footfall patterns or loyalty profiles, the system can automate day‑parting and personalise content by location without manual intervention.

Centralised control ensures brand consistency and compliance, but relevance requires localisation. A standard template might showcase a national promotion, while local layers highlight regional tastes or store‑specific inventory.

The ideal CMS allows head office to lock certain areas of a playlist (e.g., logos, legal copy) while giving store managers the ability to insert local offers. Combining scheduling rules with AI‑driven recommendations helps each store run campaigns that match its customer mix.

Merchandising managers can also use Product Zones to compare heat maps across stores and identify zones where displays are messy or non‑compliant. By connecting signage to Retail Analytics, the business can standardise the “perfect store” while respecting local nuance.

Modern shoppers value physical experiences for their emotional and human qualities. The IPG research shows that 63 percent of shoppers visit stores to fulfil emotional needs and 60 percent appreciate that in‑store and online serve different purposes.

They do not want screens that shout or track them in creepy ways. Retail media networks must respect this by delivering helpful and inspiring content rather than intrusive ads. Content should guide shoppers to discover products, help them navigate the store and showcase local offers. When technology disappears into the background and the store feels more helpful, shoppers trust the brand.

Retail media networks are not about turning stores into times squares; they are about using data and technology to create additional revenue streams while improving the shopping experience. The opportunity is massive: high margins, unplanned purchases, and brands eager to reach customers in the aisle. The challenge is execution.

Avoid the decorative trap, commit to a content strategy, measure what matters, and use centralised tools to maintain relevance across all locations. If you get those pieces right, digital signage stops being an expense and becomes an engine for earnings.

Ready to get started? Explore Merlin Cloud’s Campaigns platform to plan, schedule and measure your first retail media campaign, and visit our Kiosk Zone and Product Zones pages to discover how our solutions can turn every screen into a revenue‑driving asset.